Chapter 5

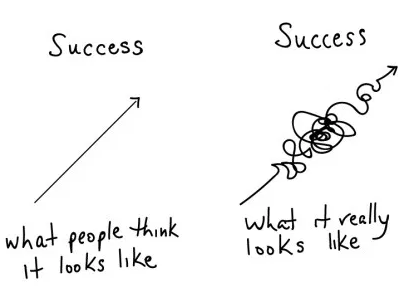

When I look back now on the past 10 years of my life, I could not have imagined where I would be now. Yes, there are some instances where I hoped to have kids (and now I do) and I hoped to have a house (and now I do), but I never could have realised the day-to-day ups and downs of life that have gotten me to where I am today. It got me to thinking, we can’t really predict exactly how our future will go, however I believe that there are practices we can put in place to ensure that our future may resemble some of our desires. If we are putting in place strategies to accomplish our goals, I believe this a solid attempt at predicting how we would like our future to be. Understandably, we can’t predict everything and we are not going to hope or plan for bad things to happen (and they will) but we can do our best to minimise the negative impact of any bad things that are going to happen. For example, I recently found out my health isn’t so great. Initially, I put it down to just being run down but now I am looking at some medical tests that may confirm a bit of a change of lifestyle for me into the future. Now, I certainly didn’t plan for this to happen, however over my working career I have put a contingency plan in place that should anything happen that may jeopardise my capacity to work for a short or long period of time that I will be able to continue to pay the bills, live comfortably and focus on getting myself back on track. It solidifies that futures are uncertain. In a firm, its value is the value it holds today. This value has been confirmed by looking at the past, which has been the focus of our study to date. However, just like predicting my own future could not be set in stone, predicting the future value of a firm cannot be set in stone either. What I take away from this study material is that the key is to know what to look for when predicting the future for a firm, knowing which numbers to crunch and what questions to ask to be able to make an informed prediction much better than any other person would.

Indirectly or not, through the processes engaged in during assessment one, I found that I was running comparatives of Citychamp Group’s economic and business realities with other firms analysed by my peers. In essence, we avoided running market value comparables amongst our firms as we were each aiming to connect with our firms and share our knowledge with each other to form deeper and more insightful assumptions.

What can we expect the future economic profit and cash flow of the firm to be? In the analysis of Citychamp Group’s past performance, ratios were calculated and it is now going to be interesting to actually understand what these ratios mean. What are my ratios going to allow me to forecast?

Forecasting EQUITY ECONOMIC PROFIT requires:

- ROE (Return on Equity) 2. Required rate of return on equity 3. Book value of shareholder equity

Forecasting ENTERPRISE ECONOMIC PROFIT requires:

- RNOA 2. Required rate of return on firm’s operations (WACC) 3. Book value of NOA

Forecasting CASH FLOW requires:

- Free Cash Flow (Operating Income minus NOA)

Essentially, what we are looking to do at this phase of the analysis is to forecast the firm’s economic profit and cash flow. This chapter has introduced us to 2 of 3 three drivers of economic profit: RNOA (Return on Net Operating Assets) & NOA (Net Operating Assets). Why do we need to understand these drivers? What are they going to tell me about my firm?

Firstly, I believe it is imperative to get my head around accounting drivers to make this process make sense to me. I’ve heard of ‘cost drivers’ before as I have had a lot of experience in management accounting in a building firm where it is imperative to analyse overhead costs in close relationship to actual building costs to determine profit per house build. I’m feeling it is a similar premise here. The financial statements aren’t the vehicle which is determining the value of the firm, their pure purpose is to provide the mechanism to PRESENT the value to the outside world. The true drivers of the firm’s value are the line items within the financial statements and these are the activities within the firm which are generating these figures. I had quite a challenge in my restating of the financials for Citychamp Group in making assumptions about its financing vs operating activities. Specifically, analysing a bank meant I had to understand that typical financing line items, such as interest income, were in fact operating activities for my firm. I understand in doing this I was analysing what was ‘driving’ the revenue figures being presented on the statements. A huge part of this understanding was to nut out the key segments of my firm’s group which I touched on in my first assessment.

Forecasting RNOA

How do I forecast the business and economic drivers of Citychamp Group’s RNOA? How do I forecast profitability and efficiency? What do I need to do to connect intelligently with Citychamp Group’s restated financial statements?

RNOA = Operating Income / Net Operating Assets

Firstly, I believe it is imperative to understand the operating income of Citychamp Group, just as Martin has done to understand his own firm Ryman Healthcare.

This practice essentially should allow me to engage with the economic and business drivers of Citychamp Group and make an informed prediction about how the firms RNOA and NOA may change into the future. It seems like a tricky task is ahead! I’m even more daunted by the fact that Citychamp Group has A LOT going on, their business segments aren’t related in a logical way. How is a watch manufacturer equipped to also be providing banking and financial services and maintain profitability and efficiency in their operations? I look forward to exploring these questions further in this assessment.

| Segment Revenue |

Watches & Timepieces HK$000 |

Property Investments $HK000 |

Banking Business HK$000 |

Total |

| 2018 |

2,444,364 |

9,586 |

483,899 |

2,937,849 |

| % Total Revenue |

83.20% |

32.63% |

16.47% |

132.30% |

| 2017 |

2,583,495 |

16,936 |

382,270 |

2,982,701 |

| % Total Revenue |

86.62% |

0.57% |

12.82% |

100.00% |

| 2016 |

2,811,352 |

19,123 |

109,480 |

2,939,955 |

| % Total Revenue |

95.63% |

0.65% |

3.72% |

100.00% |

| 2015 |

3,458,245 |

18,109 |

Nil |

3,476,654 |

| % Total Revenue |

99.47% |

0.53% |

0 |

100.00% |

I understand in predicting the future we are converting judgements into credible and critical numbers by using intelligent and sensible forecasts. What does this actually mean? In looking at Martin’s predictions of Ryman Healthcare’s key economic and business drivers of PM and RNOA the predictions have been strongly backed by a critical analysis which I also accept. The question that is asked is how do we expect these drivers to change in the future? How do we know that the drivers will change in the future? By what means and ways will they change in the future? Is the firm going to be happy if these drivers are changing into the future?

Accounting Drivers of NOA

This leads to the concept of good sales growth vs bad sales growth. I always assumed that all sales growth was always good. However, in reading this material I learnt that heavy discounting for example can result in sales growth to the detriment of investors (value destroying). The financial statements of Citychamp Group are telling me that the revenue stream for watches and timepieces is steadily declining year on year. It is interesting as there are a number of countries in which Citychamp Group retails its products and in the first assessment I discussed with another student that the Swiss brands may not be doing so well. Therefore, I can assume that Citychamp Group has shyed away from pushing up sales growth by such measures as heavy discounting. I would like to explore this further in my analysis if Citychamp Group is deciding to wear the costs of a downtown in revenue in order to maintain its “premium” product brand and image. I am also interested in looking at Citychamp Group’s market both in China and internationally and review data and statistics to form a much better view on Citychamp’s sales growth. I understand that implicitly the relationship between change in NOA and change in sales is a good thing for investors. This is because sales growth is the key driver of increasing book value NOA and increasing economic profit. At this point I found I was drawing myself little relationship mud-maps to accurately paint a picture in my head how if one driver does X, how does this affect driver Y, Z etc.

I found it quite difficult to narrow down on my key economic and business drivers for Citychamp Group at this point in time. I feel this is something I am going to have to work on quite a bit over the next few weeks. If it were just the watch operations I had to analyse I think I would be fine, however throwing in some property investment and banking in the mix is going to be interesting. Also, at this point in time life is pretty much throwing me a massive curveball and I don’t want to do any of my forecasting or assumptions light heartedly. It would be all to easy to be flippant at this point and start throwing out judgements, however these would not be credible and I would be putting the entire financial statement analysis exercise to shame. I can see just how thought out and critical Martin’s analysis of Ryman Healthcare is and I hope to inject the same passion into my own analysis.

These are my KCQs to work on:

- Key economic and business drivers of PM & RNOA. How do I predict these? Where am I going to go to find this information? Is it he financial statements alone that will give me this information or do I need to go hunting further?

- How will I expect these drivers to change in the future? Am I going to be confident in the assumptions I make about these drivers?

- Economic profit is RNOA in excess of its cost of capital (WACC) times the amount of NOA the firm has invested in its business earning to that level of RNOA. I am not understanding this concept yet. I think I need to do these calculations for myself to fully understand what this means. I grasp each concept on its own I just need to grasp the relationship.

My big takeaway message from this study material is that it’s easy to do calculations and work out ratios, however it is the predictions that need to be done with precision. It has been a fantastic journey up to this point reviewing the past where the numbers are set in stone for us. We know these things have happened and we have analysed and made assumptions about these things that have already happened. It is the future forecasts which I think are going to be so much harder. I am not yet excited about the exercise ahead. If it were an industry I was fluent in, for example building and construction I think I would feel much better. Why is this so? I think it is because I have already been through the motions, the ups and downs of what happens in a building business. I know if X does this, then Y will do that, which will result in Z. However, with watches and banking I’m a little in the dark. I have learnt through this reflection that I NEED to do much more engaging with my firm. Yes, I have done quite a lot to this point but I feel like I haven’t yet forged that really deep connection with what my firm is doing that I am really going to need over the next few weeks!

Chapter 6

‘This is the song that doesn’t end… yes it goes on and on my friend…’ Why, oh why, did I start singing this as soon as I started reading Chapter 6, Oh yes it won’t get out of my head now and it is not helping me digest any of this information! I confess I am starting to feel incredibly overwhelmed about the task ahead. I feel like this entire financial statement analysis has been a huge mountain for me that I have had to climb and I keep reaching little milestones and I do a happy dance only to look up at the top of that mountain and I still haven’t reached it yet. So, I need to take another approach. I need to tackle each little hurdle as it comes my way. Just as I need to do with analysing financial statements by taking it one step at a time, analysing each piece of the puzzle as I go and doing my damn hardest to get to a final product I can be proud of. What is this chapter of the study material trying to tell me? Well first it tells me to clean up my life, which gives me a giggle because as you have just heard I am drowning in the pressures of my own life at the moment. Thanks for the pep talk Martin! Jokes aside, my little freak out reiterates the message that financial statement analysis is a lot of hard work and I need not take any part of this practice lightly. I need to continue to plan well and adjust my time management to ensure that I am putting in the required amount of effort to get the job done!

After a quick recap of some of the formulas we visited earlier, I jump straight into understanding what part of economic profit we are trying to focus on next. It is here the concept of market values on the balance sheet are introduced and that an analysis of abnormal earnings must be done on the proviso of net assets not being at market value. I need to revisit the financials of my firm Citychamp Group I believe to understand how they are stating their assets on the balance sheet? Will I need to know this? I’ve earmarked these questions to return to. I appreciate here that accounting is not always as straight forward as it seems, I am learning this quite quickly in my new role as an assistant accountant.

It is here a new formula is introduced that I haven’t yet been exposed to. But I think I get it. It would be close to impossible that every asset on the balance sheet of a firm would be stated at market value, I would imagine it would be an incredibly huge task for a very large firm to be reviewing all assets on its balance sheet constantly and revaluing them to market value. Therefore, it makes sense that any assets on the balance sheet that are at market value don’t attract any extra value add then. They are stated for exactly how much they are worth, therefore of course they need to be excluded from our economic profit framework calculation:

V0E = BV of Equity + PV of AE from net assets not at market value

I am ecstatic that this formula, tells it exactly how it is “AE from net assets not at market value”. I wish all formulas were expressed this way!! So then I guess that I will need to know if Citychamp’s assets are stated on their balance sheet at market value or not. It is going to allow me to have a much better understanding on its economic profit if I can complete this calculation with precision.

And just after I say how I appreciate a formula that tells it how it is we are bombarded again with a HUGE list of formulas one after the other. Not so fun, but I progress through looking at each one, do I need to know this? Do I already know this? Do I understand what this means? Well, not so much at this point and Martin actually questions me, “Do you see what has changed?” Do I actually understand why the present value of Abnormal OI has replaced the present value of Abnormal earnings on equity? I understand I need to look at the NFO (Net Financial Obligations) of the firm and whether or not the firm’s NFO are at, or close to, market value on the balance sheet. This makes a big difference because it allows us for focus on the operations of the firm regardless of how it is being financed, whether it is by equity or by debt. My answer to Martin’s question, Do I see what has changed? Is essentially, NO, I couldn’t see it just by working through the formulas alone, however when I read further into the information I was able to make sense of what was going on. Citychamp Group doesn’t have NFO on their restated financial statements so what does this mean for me? They have NFE instead. Is this changing the way I approach this task. At this point I am confused, and the formulas are confusing me the more times I go over them. The study material alone is not giving me the answers I need. I am going to have to reach out to understand this further for my own analysis.

I’m going to lock down for sure that I need to understand that the drivers of Abnormal OI are:

- Return on net operating assets (RNOA);

- Cost of capital for operations (WACC-1); and

- Net operating assets (NOA) put in place to earn the RNOA.

From the outset I know this is going to be a very interesting exercise for me. Being that Citychamp’s operating activities are largely financing activites and I had to make some pretty difficult assumptions about this I wonder if it is going to impact how I tackle understanding the drivers of Citychamp’s Abnormal OI. I am really interested to see if the banking business is largely attributable to the Abnomal OI – being that financial products are a very unique type of product. I already have so many questions swimming around in my head about what is the actual capital for such a business, what are their operating assets? At this point I am looking at my ratios and I have so many more questions than I have answers about Citychamp Group at this point. I understand that this reflection is not mean to delve into and explain these at this point in time, however I feel I am starting to generate these questions and exploring avenues of enquiry that I know I need to do so that I feel much more connected with my firm.

In my previous roles, I have never had to do any type of ratio analysis or explore any of these concepts before so I am finding it difficult to connect on a personal level with what the study material is telling me. I am just trying to wade through the content bit by bit and start to add this information to my knowledge bank. I am writing down my avenues of enquiry I need to follow up and the many questions I am starting to have about my own firm. I say this because, when I am just not connecting with content and it’s not relatable to me I am finding it very difficult to offer an insightful review on the content. This is how I am feeling as I start to work through the material on capital.

Costs of Capital Interact

‘ we stick together, because opposites attract’.. or ‘costs of capital interact’. I’m singing along again, I think the insanity is starting to set in and my mind is wandering to so many places I don’t need it to be right now!

Ok, so I am good with the WACC formula and what it means however I was introduced to a new concept that forms part of the firm’s equity risk and equity cost of capital scenario:

- Operational risk (WACC); and

- Financial risk, comprising leverage (V0D/V0E) and spread (WACC – ρD).

Immediately I don’t know what this is trying to tell me? I understand we are focusing on capital now but what exactly should I be trying to digest from the content? I read over and over and over again and the conclusion I came up with is that, I still don’t get it! So I am going to piece it out step by step and see if it helps me:

- Citychamp Group increases its leverage so its equity cost of capital will increase

- This will then increase the ROE

- They should then offset (if the debt markets are efficient)

- This would mean the financing of a firm between debt and equity will have no effect on future economic profit

Ok, so is this content really about how a firm is financing its operations? Is that what I should be focusing on? Once again, I really don’t think I have understood yet Citychamp’s Group’s position on leveraging? Is the earnings growth of the group represented accurately? I need to review these questions with urgency to gain a better understanding. Once again, there is banking and property investment involved so I can assume that financial leverage is a very important factor at play. I cannot underestimate just how important it is going to be for me to get a handle on this for my analysis. Understanding just what is going on with my firm and then running comparatives with other banking and financial entities in similar markets may be important for me to understand the leveraging relationships discussed in this material. I worked through Martin’s example on Ryman Healthcare and I can see how taking each formula step by step, running the calculation and working out what this is actually telling us is going to be imperative for my own analysis. When I am working through discussion on Citychamp I think I am definitely going to work through his example alongside mine to offer some support as I feel I am going to find this next phase of the assessment very challenging! It is interesting how some accounting subjects have just clicked with me and others I have had such a hard time getting and connecting with. Sorry Martin, but this subject is one I am just having a very hard time with. I promise you though, it has opened my eyes to the way I learn and the improvements that are there ready and waiting for me so that I can work so much better into the future. There we go, making a solid prediction for the future!

What I take away from the content as a whole and from my own struggles in connecting with the content is that it is so easy to get put-off by the big picture and when a task looks huge it can create some pretty intense anxiety about how to accomplish it! What I have learnt through this study material is that financial statement analysis however has an element of making things simpler. By understanding what we really want to know and eliminating the information we don’t need to have a sharper, clearer focus. With this focus, we can then understand what is truly adding value to our firm. We can take out any ‘fabricated’ information, for example eliminating financial leveraging which could allow for a construed picture of just how well the firm is doing in generating an economic profit. I don’t look forward to, but am interested to see how my focus is in completing my indepth analysis of Citychamp Group and if I have the capacity to see everything that is important in forecasting the future!